ECONOMY | Trends in lighting rebates for 2024

In 2024, commercial lighting rebates remain a strong, widely available incentive for adoption of energy-efficient lighting and controls in existing buildings. Trends among prescriptive rebates include softening demand for rebate dollars, more bonus programs, generally increasing average rebate amounts, and growth and increasing standardization with networked lighting control (NLC) rebates.

In review, rebates are programmed investments by utilities and energy efficiency organizations in reducing electric power demand, as this is generally more cost-effective than new supply. Traditionally, these programs placed a heavy focus on lighting and are primarily targeted to existing buildings.

Rebates may be custom or prescriptive. With custom rebates, the project team proposes an innovative design that goes beyond the prescriptive program. Prescriptive rebates offer a cash amount per qualifying installed energy-efficient product, awarded at the point of sale (midstream) or more commonly to the owner (downstream) via a pre-approval process. As downstream prescriptive rebates are the most common form for commercial lighting, they are the focus of this article.

General trends

According to rebate fulfillment firm BriteSwitch, which shared its Rebate Pro for Lighting database, nearly 80% of the United States continues to be covered by an active commercial lighting rebate.

Demand for rebate dollars appeared to soften in 2023. Whereas in the past as many as 25% of programs would typically report running out of funding before the end of the year, fewer reported this in 2022 and only 5%. One-fifth of programs offered accelerated rebates in the second half of the year to meet energy savings targets, some of these continuing into the first quarter of 2024.

This may be due to LED saturation, as adoption of LED technology is exceeding 50% of the installed lighting base in various regions. Utility consulting firm DNV recently reported that LED share of the linear ambient lighting market in Connecticut, Massachusetts, New Jersey, and Rhode Island was over 70% in 2023. As early adopters and the early majority install LED lighting, the late majority and laggards are more challenging to capture, making rebates even more important but seeing projects occur at a lower volume.

LED product rebates

Commercial lighting rebate programs have firmly embraced LED technology for years. In 2024, the most popular rebates continue to be LED replacement lamps, troffers/flat panel, downlight, wall-mount, parking garage, outdoor pole-arm mount, and high-bay luminaires.

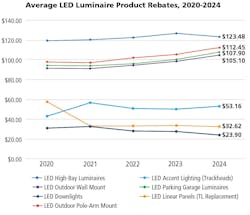

After years of declining average rebates reflecting declining market costs, LED rebates stabilized in 2021 and have since held and even increased, likely due to inflation. In 2024, LED products as a whole saw an average 2% increase, with the biggest increases (6–7%) being for LED outdoor and parking garage luminaires, according to the BriteSwitch database (see Fig. 1).

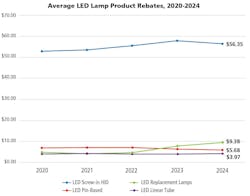

LED replacement lamps are more of a mix. Rebates for certain LED replacement lamps were expected to be eliminated after federal legislation eliminated a majority of the remaining traditional general-service, medium-base lamps, but some survived, with average rebates significantly increasing in 2024 (see Fig. 2).

Meanwhile, horticultural lighting rebates emerged in the last two years as a strong specialized category. In 2024, nearly 650 programs are offering an incentive for horticultural lighting, with the average prescriptive rebate being about $100 per luminaire, according to BriteSwitch.

Lighting controls

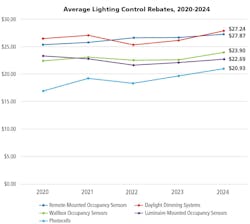

In most of the U.S., if a lighting rebate is available, one is available for controls as well. Popular rebates include remote-mounted, wallbox, and luminaire-mounted occupancy sensors; photocells; and daylight dimming systems, as shown in Fig. 3. In 2024, these categories experienced average increases of 2 to 7%. The high average dollar amounts position lighting controls as an attractive upfront addition to a lighting upgrade.

Networked lighting control rebates are showing signs of standardization as a relatively new specialized rebate category. NLCs are intelligent systems in which devices are connected within a network to enact control strategies. This type of system can produce substantial energy savings, making it attractive for adoption by rebate programs, while availability of data can produce non-energy benefits.

Traditionally, incentive programs treated networked controls as a custom option, but in recent years, a significant number of prescriptive rebates became available. This coincided with a new DesignLights Consortium (DLC) Qualified Products List for Networked Lighting Controls, used by a majority of prescriptive programs to qualify systems as being eligible for rebate.

According to BriteSwitch, the number of utilities offering incentives for NLCs grew by 8% in 2024 to 450, with about 53% of the rebates being prescriptive. Additionally, most are offered on a per-luminaire basis, with an average of $211 per luminaire installed and controlled.

Getting rebates

To determine rebate availability in your area, contact local utilities and energy-efficiency organizations. Some manufacturers offer resources to identify opportunities. To get the most out of such local programs, consider enrolling as a Trade Ally, which may offer market visibility and access to training and other resources. Otherwise, in-house resources or outsourcing are typically required to manage the process.

Since rebate programs are largely unstandardized, be sure to learn the given program and its requirements, and keep tabs on changes and current funding levels. While less common, in some regions participation may drain funds early. Note that rebates are not guaranteed or may pay a lower-than-expected amount.

Pre-approval is often required before installation begins. All forms must be properly completed. Note what products qualify — such as whether they require DLC listing — and ensure the exact model is listed. Inspection (onsite or virtual) may be required to verify installation.

The future of rebates

Rebate programs evolve with technology and the marketplace, so as LED saturation increases, incentives are likely to adapt so they can continue to derive substantial lighting energy savings.

Likely to be on the menu for evaluation and potentially future promotion are high-efficiency LED lighting; replacing first- with current-generation technology (possibly with a $/W instead of a per-product rebate); lighting redesign; tying lighting and controls as a package; networked and luminaire-level lighting controls; HVAC integration; and specialized applications such as UV disinfection, data, and tunable lighting. As lighting controls are underutilized in existing buildings, they are likely to play a strong role in the rebate mix moving forward.

Put rebates to work

Commercial lighting rebates have offered a powerful incentive for buildings owners to adopt energy-efficient lighting and controls. While rebates can require effort and pose a degree of risk, numerous building owners have tapped them to help fund installation of new lighting and controls.

The overall outlook for commercial lighting rebates in the U.S. in 2024 is very strong, with widely available rebates supported by freely available, detailed listings of qualified products. They are particularly attractive for projects involving solutions adding lighting controls, including NLCs. While capturing lighting upgrade projects may become more challenging as LED saturation increases, rebates can play a significant role in converting this business.

CRAIG DILOUIE, LC, CLCP is education director for the Lighting Controls Association, a council of the National Electrical Manufacturers Association that educates the public about lighting control technology and application.

Follow our LinkedIn page for our latest news updates, contributed articles, and commentary, and our Facebook page for events announcements and more. You can also find us on the X platform.

Craig DiLouie

Craig DiLouie, LC, CLCP, is education director for the Lighting Controls Association, a council of the National Electrical Manufacturers Association dedicated to educating the public about lighting control technology and application. Learn more at lightingcontrolsassociation.org.

![The DesignLights Consortium continues to make progress in shifting outdoor lighting products and implementation practices toward a more restrained and thoughtful strategy. [Image does not represent a DLC qualified fixture.] The DesignLights Consortium continues to make progress in shifting outdoor lighting products and implementation practices toward a more restrained and thoughtful strategy. [Image does not represent a DLC qualified fixture.]](https://img.ledsmagazine.com/files/base/ebm/leds/image/2024/08/66be810888ae93f656446f61-dreamstime_m_265700653.png?auto=format,compress&fit=&q=45&h=139&height=139&w=250&width=250)